Smallholder producers of natural rubber are seeing greater impacts from the COVID-19 pandemic than larger producers, according to latest analysis by ZSL (Zoological Society of London) of the world’s most significant natural rubber producers and processors.

Despite a surge in demand for some natural rubber products – such as latex gloves – in response to the coronavirus outbreak, the volatile nature of the rubber market saw prices decline sharply at the beginning of the pandemic – likely due to lower-than-expected sales in the US and EU as demand from the automotive and transport industry plummeted. Due to their size, and lack of ability to diversify their income streams, smallholders are less able to withstand the pressures of an unreliable income than the larger producers.

Produced by ZSL’s SPOTT team, the report is the second annual assessment of 15 natural rubber producers and processors on their public disclosure regarding their organisation, policies and practices related to environmental, social and governance (ESG) issues. Controlling a combined total of 1.4 million hectares of land, each company receives a percentage score to benchmark their progress over time.

The average score of all 15 companies evaluated increased from 36 percent to 41 percent showing a marked increase in transparency and public commitments year-on-year. Three companies* saw their score increase by at least 20 percentage points from the previous assessments: Indofood Agri Resources Ltd, Kirana Megatara, and Société Internationale de Plantations d’Hévéas (SIPH).

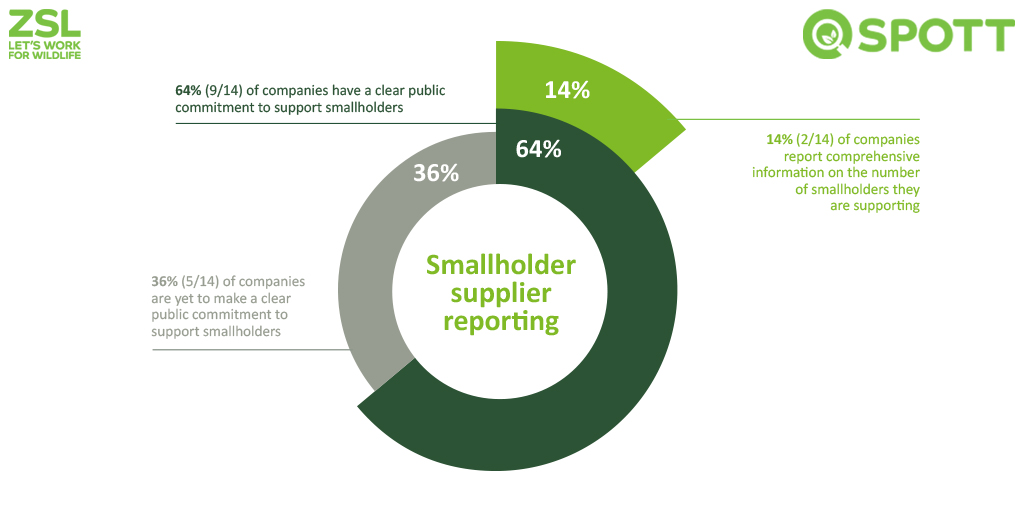

However, the assessment also found that while 64 percent (nine out of 14) of the world’s most significant producers that have smallholder suppliers have made a clear commitment to supporting those smallholders, just 14 percent (two out of 14) provide comprehensive detail on the actual number of smallholders they are supporting – with conservationists suggesting that the lack of publicly available data means it is not possible to know whether major producers are fulfilling their agreements to provide technical and financial assistance to smallholder farmers.

Responsible for producing 85 percent of natural rubber globally, smallholders across tropical landscapes, primarily in South East Asia, generally cultivate monocultures – single crop farms – that leave the landowners particularly vulnerable to fluctuating demands and market conditions. This unpredictability can create pressure to clear land to generate income, risking the destruction of precious wildlife habitats.

Sam Ginger, the ZSL analyst who led on the report said: “Our analysis suggests the world’s most significant natural rubber producers are failing to report on how they are supporting smallholder suppliers to improve the profitability and sustainability of their farms. As rubber production increases due to a rising global demand for vehicles and pandemic medical supplies, companies have a responsibility to engage with their suppliers to ensure that sustainability requirements are upheld.

“The knock-on impact of COVID-19 proved just how vulnerable the smallholders can be, but larger companies can support them by providing financial help and technical training to diversify their income, like teaching agroforestry techniques – where crops are grown on the same land as rubber trees to create a more diverse farming system – which in turn can supplement incomes, increase the rubber yield from each tree, and keep forests standing.”

Further compounding the risk of habitat loss, is a lack of supplier engagement on the sourcing processes of the commodity. 21 percent (three out of 14) of companies have a clear process by which they engage and/or assess smallholders on their compliance with company sourcing policies, but only seven percent (one in 14) report the number of smallholder suppliers they have engaged/assessed.

Ginger added: “Engagement with suppliers in the natural rubber supply chain allows a constructive, good faith dialogue about company requirements on sustainable practice, and makes clear the operational changes that suppliers may be required to make. Suppliers will also be able to make clear the support they require to achieve these requirements.”

Mainly used by the medical and automotive industries – with 75% of natural rubber used for the production of tyres due to its unique properties – a coalition of tyre manufacturers, producers and civil society organisations established the Global Platform for Sustainable Natural Rubber (GPSNR) in 2018. GPSNR has a dedicated membership category for smallholders to ensure voices can be heard alongside international corporations and NGOs in discussions determining the direction of sustainability within the sector. GPSNR company members commit to align their production and procurement policies with the GPSNR Policy Framework. This year, the six GPSNR members assessed on SPOTT scored an average of 58 percent, compared with 30 percent for non-GPSNR members (nine companies).

Stefano Savi, Director, Global Platform for Sustainable Natural Rubber said: “Supplier transparency is vital in order to achieve GPSNR’s goal of improving the social and environmental performance of the natural rubber value chain.

“While we’re pleased to see GPSNR members achieve higher scores than their non-member peers in this year’s SPOTT assessments, there is still room for improvement. It’s vital that smallholders are provided with comprehensive technical and financial support to ensure that sustainability becomes standard practice amongst all suppliers. This can only be achieved if it becomes a shared responsibility of all supply chain players, and GPSNR will continue building systems to enable this change.”

ZSL’s conservationists are urging downstream buyers and financial institutions, such as tyre manufacturers and investors, to publish their own sustainability policies and use their influence to ensure commitments are being implemented and reported on across the whole supply chain – ensuring that the sustainable and equitable production of natural rubber can continue whilst enabling the recovery of wildlife within the landscapes it occupies.

* Natural Rubber Producers with most increased scores Nov 2019-Mar 2021:

Indofood Agri Resources Ltd (+28.79 percentage points), Kirana Megatara (+22.46 percentage points) Société Internationale de Plantations d’Hévéas (SIPH) (+20.04 percentage points).