| Position Title |

Sustainable Finance Specialist (Tiger Conservation Coalition) |

|

Location

|

Flexible within Asia – Thailand, Malaysia, Nepal or Bhutan preferred |

| Contract Form |

Full-time equivalent consultancy (225 days/year) |

| Contract Period |

Two years |

| Contract Value |

Dependent on location |

| Department |

Sustainable Business & Finance |

| Directorate |

Conservation & Policy |

| Responsible to |

Senior Sustainable Finance Specialist (Asia) |

| Approved by |

Head of Department |

| Payment Terms |

Monthly on submission of invoices, with evidence of work and

expense claims |

About ZSL

The Zoological Society of London (ZSL), a charity founded in 1826, is a world-renowned centre of excellence for conservation science and applied conservation. ZSL’s purpose is to inspire, inform and empower people to stop wild animals from going extinct. This is realised by carrying out field conservation and research in over 50 countries across the globe and through education and awareness raising at our two zoos, ZSL London Zoo and ZSL Whipsnade Zoo, inspiring people to take conservation action. Sitting within the Sustainable Business & Finance Department, the Sustainable Finance Programme aims to close the $1 trillion financing gap for nature, through working both on the demand side with investors to increase the financing for nature, and on the supply side to develop investible, nature positive projects and enterprises.

About the Tiger Conservation Coalition

The TCC brings together leading biologists and experts in wildlife crime, human-wildlife coexistence, policy, finance, development, and communications, with unprecedented alignment on achieving tiger conservation at scale. Its member organisations include the International Union for Conservation of Nature (IUCN), the Environmental Investigation Agency; Fauna & Flora; Natural State; Panthera; TRAFFIC; the United Nations Development Programme (UNDP); the Wildlife Conservation Society; Worldwide Fund for Nature (WWF) and the Zoological Society of London (ZSL). The recruitment supports the Tiger Conservation Coalition’s goal to develop sustainable financial strategies for tiger conservation aiming to mobilise USD 1 billion in additional funding by 2034, as pledged at the Sustainable Finance for Tiger Landscapes Conference in Bhutan on April 2024.

A key element of the sustainable financing strategy of the TCC is to select, design, develop and test various financing mechanisms in selected tiger landscapes, tailored to address specific conservation threats and deliver measurable conservation outcomes. The TCC has previously commissioned sustainable financing plans for four tiger landscapes across five countries, including Bhutan, Malaysia, Kazakhstan, India and Nepal. The plans assessed over 20 nature financing mechanisms and identified the most suitable ones based on their relevance and feasibility. The Sustainable Finance Specialist will build on these plans to further work on the sustainable finance mechanisms in three of the landscapes, as outlined in this Terms of Reference.

Purpose

The Tiger Conservation Coalition (TCC) is looking for a Sustainable Finance Specialist or an environmental economist (to be based with ZSL) to support the development and implementation of nature financing instruments in support of tiger and tiger landscape conservation across current and former tiger range states.

Major Duties and Responsibilities

- Develop and maintain a work plan for the activities to be undertaken by the Sustainable Finance

Specialist under the scope of this ToR

- Review and analyse the existing financing plans to select up to two mechanisms per landscape to

test

- Perform further analytical work for the conceptual development, refinement and customization

of the selected instruments, including but not limited to financial/economic analyses and

calculations, revenues, expenditure and impact modelling, activity design and scenario-based

forecasting to ensure the financial viability and alignment to conservation goals

- Develop detailed implementation plans for the selected mechanisms

- Define the legal, implementation, and monitoring and verification frameworks, including but

limited to required partnerships, regulatory needs, and operational steps for each pilot

- Consult or guide the consultation with local stakeholders to assess willingness and readiness to

participate in or contribute to the financing schemes

- Support the fundraising, investment readiness and roll-out of sustainable finance mechanisms in

collaboration with local partners

- Share lessons learned and best practices with the Tiger Conservation Coalition

- Provide an outline of a sustainable finance strategic approach and action plan to be approved by

the TCC and Finance Sub-Committee Chairs

- Facilitate technical discussions during TCC meetings and join Working Group meetings as and

when required between TCC members.

The duties and responsibilities described are not a comprehensive list and additional tasks

may be assigned from time to time that are in line with the level of the role

Key Selection Criteria

- Degree in a topic related to sustainability, finance and/or biodiversity or equivalent work

experience

- Experience in research and analysis on topics related to sustainable finance

- Experience of working with international teams in cross-cultural environments

- An understanding of financial institutions and the investment, lending and asset management

process

- An understanding of key trends and topics in sustainable finance and investing in nature

- Experience writing grant applications and/or consulting proposals

- Experience manipulating and analysing quantitative datasets

- Demonstrated passion for nature and biodiversity

- A willingness to travel nationally and internationally.

Application Process

Submit a CV and cover letter that addresses the key selection criteria to reuben.clements@zsl.org

by 12pm BST on Monday, 23 Jun 2025

| Position Title |

ZSL India Enterprise Consultant |

|

Location

|

Flexible within India, with travel to Palk Bay region |

| Contract Form |

Fixed Value Consultancy (GBP 10,000 plus expenses) |

| Department |

Sustainable Business & Finance |

| Directorate |

Conservation & Policy |

| Responsible to |

Conservation Enterprise Specialist & Project Manager |

| Approved by |

Sustainable Finance Programme Manager |

About ZSL

The Zoological Society of London (ZSL), a charity founded in 1826, is a world-renowned centre of excellence for conservation science and applied conservation. ZSL’s purpose is to inspire, inform and empower people to stop wild animals from going extinct. This is realised by carrying out field conservation and research in over 50 countries across the globe and through education and awareness-raising at our two zoos, ZSL London Zoo and ZSL Whipsnade Zoo, inspiring people to take conservation action.

About the Project

The Palk Bay region of Tamil Nadu is home to diverse coastal and marine ecosystems, including seagrass meadows, coral reefs, and endangered species such as the dugong. Local communities rely heavily on fishing and natural resources, making sustainable livelihoods a priority.

Through its Sustainable Business and Finance Programme, ZSL is exploring community enterprise models in the Palk Bay region that align with conservation and sustainable development goals. This consultancy will assess the feasibility of three local enterprise opportunities: ecotourism, solid waste management, and seaweed aquaculture, supporting pathways to investment and long-term benefit-sharing for coastal communities.

Purpose

The Local Enterprise Consultant will conduct a feasibility and business model study for three local enterprise types. The role will include market and stakeholder analysis, capital cost assessments, and identification of steps to investment. The consultant will liaise closely with ZSL experts and engage with key supply chain actors to gather critical input for designing viable, inclusive, and sustainable enterprises.

Key Responsibilities

- Enabling Environment Review

Identify the key regulations determining the operations of ecotourism, solid waste management, and seaweed aquaculture in the Palk Bay region.

Conduct market demand and supply chain assessments for each enterprise, identifying trends, competitors, and buyer interest.

- Business model development

Develop tailored business models for each enterprise, including cost structures, income streams, and operational plans.

- Financial modelling and investment planning

Develop financial model for each enterprises from startup to maturity, including start-up costs, capital requirements, income and expenditure and profitability

- Benefit-sharing mechanism

Propose equitable benefit-sharing mechanisms aligned with conservation and community priorities.

Identify capital requirements, potential financing sources or partners, define next steps towards attracting investment, including key enablers, risk mitigation, and governance structures.

Present the results of the research to ZSL and other key stakeholders in the region.

Deliverables

| Deliverable |

Due Date |

|

Enabling environment review

|

25 May

|

|

DRAFT Market analysis and business model design

|

20 June

|

|

DRAFT Financial model, benefit sharing mechanism and investment roadmap

|

20 June

|

|

Final consolidated report and presentation

|

30 June

|

Travel Requirements

- Field travel to relevant locations in the Tamil Nadu region.

Budget and Payment Schedule

| Line Item |

Amount Available |

| Technical inputs form consultant |

GBP 10,000 |

| Transport, accommodation and subsistence |

Up to GBP 2,000 |

| TOTAL |

Up to GBP 12,000 |

Payment Schedule

- 33.3% on contract signature and deliverable one

- 33.3% on acceptance of deliverable two and three

- 33.3% on acceptance of deliverable four

All claims for expenses are dependent on submission of a valid invoice and receipts for reimbursement. Alcoholic drinks and personal services except drivers and laundry are not valid for reimbursement.

The consultant will be responsible for the payment of all taxes and charges associated with the works.

Selection Criteria

- A degree (or equivalent experience) in business, sustainable development, conservation, or related fields.

- Demonstrated experience in enterprise feasibility, livelihoods, or business model development within India.

- Understanding of coastal and marine contexts, especially in Tamil Nadu.

- Experience working with local communities and conducting stakeholder engagement.

- Strong research, analysis, and reporting skills.

- Fluency in English and Tamil.

- Willingness to travel to remote coastal locations in the Palk Bay region. Living in the region a plus.

Application Process

Submit a CV and cover letter addressing the selection criteria to sbf@zsl.org by 20 May 2025.

Have your say on the SPOTT 2025 Palm Oil Indicator Framework

We invite you to provide feedback on the SPOTT Palm Oil indicator framework as we prepare for the 2025 assessments.

Each year we review the indicator framework to ensure it is in line with best practice and provide more detail/clarity on how information is scored. The consultation period starts today and lasts until Monday 19 May, please read the framework and provide feedback on indicators.

Key updates in the 2025 assessment

To ensure SPOTT continues to align with best practice reporting standards, we have introduced three key updates this year:

- New cross-commodity zero deforestation indicators for companies operating across multiple forest-risk commodities (indicators #60 and #61)

- New indicators on target dates to achieve zero deforestation (indicators #62 and #63)

- Separate reporting of absolute and intensity GHG emissions in line with SBTi FLAG guidance (indicators #104 – #111)

Please note that all new indicators will be assessed but not scored in the first year. Several existing indicators have also been revised, either in response to previous feedback or to improve alignment with SPOTT’s frameworks for Timber and Pulp and Natural Rubber, as well as with relevant external guidance.

How to submit your feedback

We welcome your feedback on any indicators. Please download the indicator framework and add your comments in the ‘Reviewer comments’ column (Column P). New indicators and those with revised scoring criteria are highlighted in Column H, with further context provided in Column I. Please return the attached Indicator Framework document with your feedback by Monday 19 May to imogen.fanning@zsl.org.

2025 SPOTT Palm Oil Assessments Provisional Assessment Timeline

- June-August 2025 – Analysts score company reporting and create a draft SPOTT assessment for each company

- August-September 2025 – Assessed companies are consulted on their draft assessments

- November 2025 – The finalised assessments are published on the SPOTT website

SPOTT pilots Mike Hudson Foundation’s AI tools Knowbot and Longseek

Enhancing website usability with Knowbot

SPOTT is to integrate Mike Hudson Foundation’s (MHF) website search tool, Knowbot, into its website. Knowbot solves the problem of users struggling to find information on large websites.

Annabelle Dodson, Sustainable Business Project Manager at ZSL, said “By helping users get the information they need, Knowbot will make SPOTT even more accessible. It will save our users’ time and improve how they engage with our data.”

Mirjam Hazenbosch, Sustainable Business Programme Manager at ZSL said “We love that users can just ask questions in plain language and get accurate answers based on our website. Users know they can trust Knowbot’s answers because it always provides citations”.

For example, financiers looking to prioritise engagement asks can use Knowbot to summarise key social risks identified based on a company’s ESG disclosure, or quickly compare companies on a specific indicator to assess how one company performs against its peers.

Improving ESG assessment efficiency with Longseek

In addition, we are currently exploring new ways to improve the efficiency of our SPOTT assessments using the advances of AI. SPOTT is testing MHF’s new experimental AI tool, Longseek, which is powered by a Large Language Model (LLM).

LLMs are a specialised type of AI trained on massive amounts of text data, enabling them to understand and generate responses in natural, human-like language with a high degree of accuracy. Longseek is being developed to help researchers analyse large, unstructured information sources.

Oliver Cupit, Sustainable Business & Finance Programme Manager at ZSL, said “The increased efficiency we hope to get from Longseek’s AI may enable us to gradually scale SPOTT in the future – whether that means covering more companies or exploring additional sectors.

“By using AI to further increase supply chain transparency for investors, buyers, banks and other stakeholders, we hope to incentivise more companies to implement corporate best practices and improve sustainability. We look forward to revealing more about this and the results in the near future.“

Beyond this, LLMs have a great variety of potential applications to assist professionals across various domains, from monitoring and analysing data from remote sensing or satellite imagery, to tracking market trends and emerging risks through news coverage and social media.

However, as a part of ZSL, a conservation charity, we recognise the environmental footprint of large AI models due to their high resource demands. We are also aware of concerns of automation and its impact on jobs. Any use of AI on SPOTT is designed to support, not replace, the skilled work of our team.

Human judgment and verification remain essential in our assessments, and our analysis will continue to rely on publicly available information and scientific data.

About the Mike Hudson Foundation

Mike Hudson Foundation is a nonprofit providing free use of AI tools and pro bono advice to research-oriented nonprofits.

Oliver added: “Mike has been a great supporter of ZSL for many years. It’s fantastic that he’s now turned his focus to AI and we’re delighted to be working with his foundation and grateful for his support.”

Mike Hudson said: “We’re incredibly pleased to be working with ZSL and the SPOTT team in particular. ZSL is a world-class conservation institution producing crucial information and research. SPOTT is doing remarkable work raising the bar on sustainability and we’re proud to support them.”

To find out more about Knowbot & Longseek contact MHF via www.mikehudsonfoundation.org

To find out more about ZSL’s SPOTT collaboration with Mike Hudson Foundation get in touch with ZSL’s Sustainable Business & Finance team.

Assessing the Impacts and Dependencies on Nature: A Case Study with Scottish Widows

Why nature is rising up the finance agenda

Nature and biodiversity are becoming central concerns for investors, and rightly so. According to PwC, approximately 55% of global GDP – equivalent to around US$58 trillion – is moderately or highly dependent on nature, encompassing vital ecosystem services like clean water, pollination, and climate regulation. However, biodiversity is under threat, and financial institutions are increasingly expected to assess how their investments both rely on, and impact nature.

A first-of-its-kind case study with Scottish Widows

To better understand their nature-related risks and opportunities, Scottish Widows, one of the UK’s largest pension providers, partnered with ZSL to assess their diversified investment portfolio. This first-of-its-kind case study provides a real-world example of how an asset owner can begin to navigate nature-related issues using openly available tools, sector-level analysis, and frameworks such as the Taskforce on Nature-related Financial Disclosures (TNFD) LEAP. It highlights practical insights and common challenges, like limited company and location-specific data, while showing that meaningful progress is possible. The collaboration also served as a valuable capability-building exercise, helping inform future analysis and investor action to better manage environmental risks and improve customer outcomes. Our case study shows how an investor can:

- Identify high-impact and high-dependency sectors using the ENCORE tool

- Understand portfolio exposure to the five key drivers of biodiversity loss

- Translate findings into actions for engagement, stewardship and strategy

- Navigate data gaps and select fit-for-purpose assessment methods

- Build internal capability for nature-related risk management

Why it matters now

Financial institutions can no longer afford to overlook nature-related risks and impacts. As global biodiversity declines and regulatory and market expectations rise, understanding how portfolios interact with nature is becoming essential. Nature loss poses material financial risks, whether through disrupted supply chains, stranded assets, or reputational damage, and financial institutions are expected to play a key role in reversing this trend. Our recent case study helps demonstrate how nature-related risks and opportunities can be assessed in practice. Finally, with nature and climate inextricably entwined, acting now is critical to safeguard both long-term financial value, as well as planetary health.

Our case study is relevant for:

- Pension funds and asset owners exploring biodiversity risk

- ESG and stewardship professionals building engagement strategies

- Sustainability teams and consultants navigating TNFD alignment

- Anyone in the finance sector seeking to understand their role in halting biodiversity loss

Work with us on nature-related risk and opportunity

If you’re interested in learning more about this work or would like to explore how we can support your organisation in assessing nature-related risks and opportunities, we’d love to hear from you. To get in touch or find out more about our advisory services, visit Advisory Services and Training | ZSL

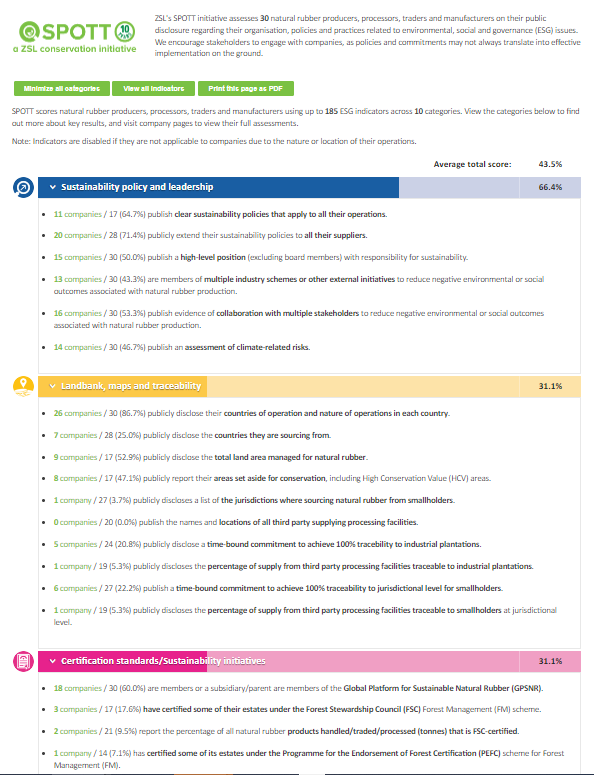

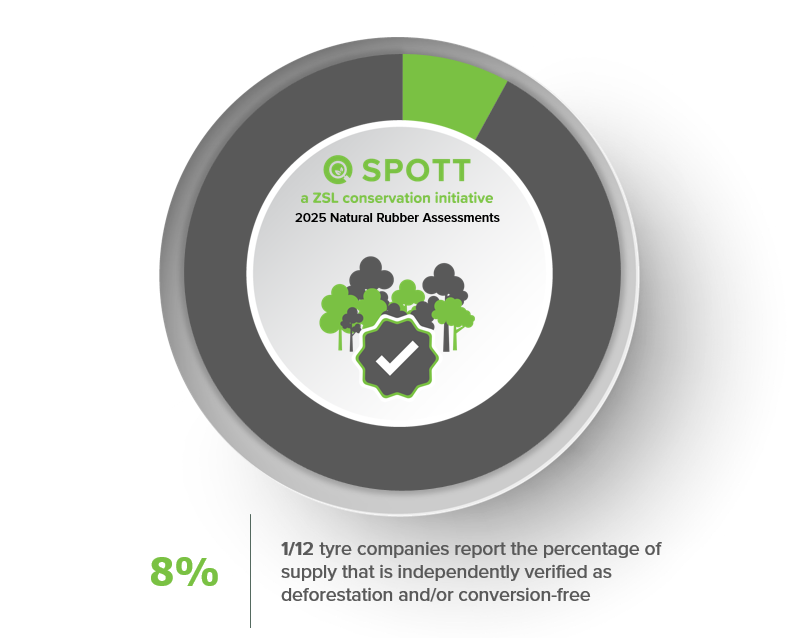

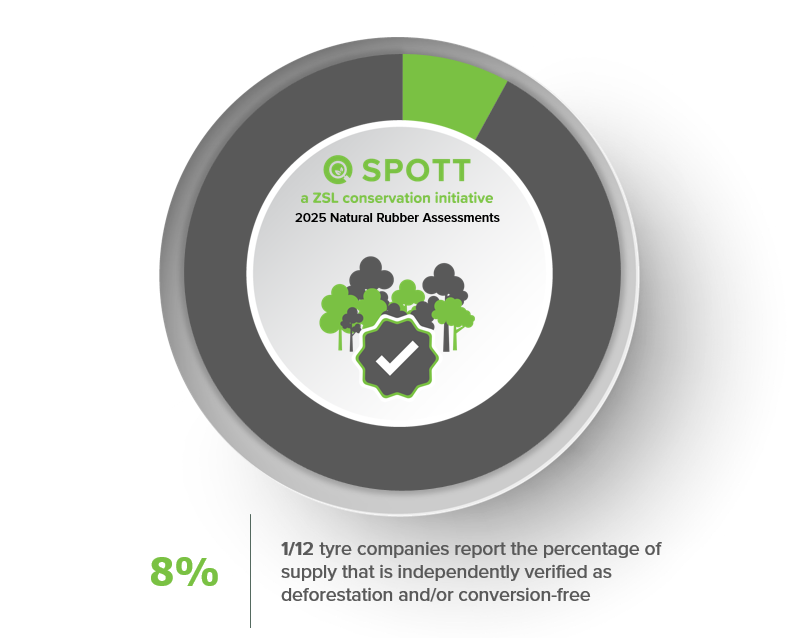

Michelin is the only major tyre company to report verified evidence that sections of their supply chains are deforestation-free, reveals ZSL’s latest assessment on the natural rubber sector – highlighting the vital need for companies to address deforestation and accelerate the industry towards a healthier future.

Published today (26 March 2025), the latest SPOTT report from international conservation charity ZSL, which evaluates progress in the industry’s environmental, social and governance (ESG) public disclosure, reveals that out of twelve of the world’s largest tyre companies, only the French manufacturer reported evidence that parts of its rubber supply chains are free of deforestation. As of the end of 2023*, only 9% of their total supply chain was covered by this evidence, with the majority yet to be verified.

The remaining 11 companies assessed – including Pirelli, Goodyear and the world’s largest tyre manufacturer, Bridgestone – failed to report that their supply chains avoid deforestation, despite risking shrinking market access due to incoming EU regulation and the sector’s increased vulnerability to climate change.

The team behind the assessment are calling for natural rubber companies to urgently publicly disclose supply chain information, monitor deforestation and verify sustainability claims to drive the industry towards a more resilient future – and encourage buyers, investors and policymakers to push for this change.

Sam Ginger, Sustainable Business Specialist at ZSL who led the report, said: “No sustainability target is achievable without traceability; if you can’t map it, you can’t manage it. We rely on tyres every day. From food lorries helping put meals on family dinner tables, to ambulances rushing people to life-saving medical attention, rubber is at the centre of modern life. But we also rely on the world’s forests for clean air to breathe and a healthy climate that supports life as we know it – yet the natural rubber sector is putting our planet’s ‘lungs’ at risk.”

In light of the global importance the world’s forests play in keeping the Earth’s climate stable and habitable, in 2021 world leaders from over 140 countries committed to halt and reverse deforestation by 2030, a set of commitments known as the Glasgow Leaders’ Declaration on Forests and Land Use.

Sam added: “If the industry continues this way, it risks derailing rapidly approaching global targets to halt deforestation – simultaneously makes itself vulnerable to collapse, while also fuelling climate instability worldwide. But if companies instead step up and take responsibility for protecting and restoring our natural air purifiers, they can speed up action towards creating a cleaner, healthier future for all.”

Industrial rubber processors play a key role in traceability – but few disclose where their rubber comes from or how it’s sourced

This issue extends throughout the natural rubber sector; only 4 out of 28 natural rubber companies (14%) publish evidence of monitoring deforestation in their supply chains, raising further concerns about the industry’s commitment to preventing forest loss and putting companies at risk of market exclusion due to the incoming EU Deforestation Regulation (EUDR). Despite approaching sustainability deadlines and increasing pressure from investors, many companies remain slow to act – putting their operating models at risk while simultaneously undermining global efforts to end deforestation for the benefit of people and wildlife worldwide.

The EUDR sets out that companies importing to the EU must know the origin of their rubber supply and ensure it is not harvested from land deforested after 2020. Failure to comply with the requirements set by the EUDR will put companies at serious risk of exclusion from the EU market, facing supply chain disruptions, regulatory penalties, and reputational damage.

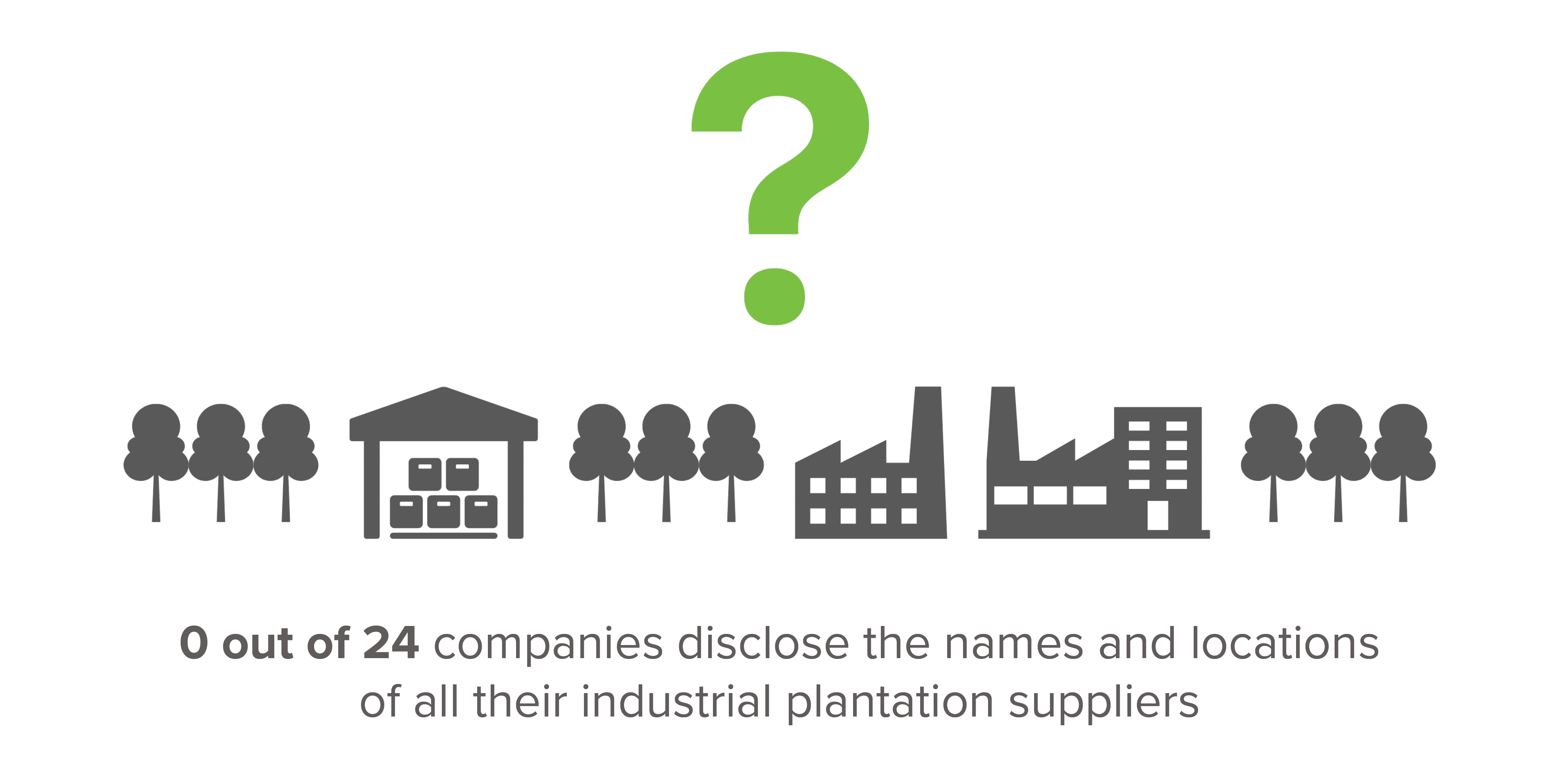

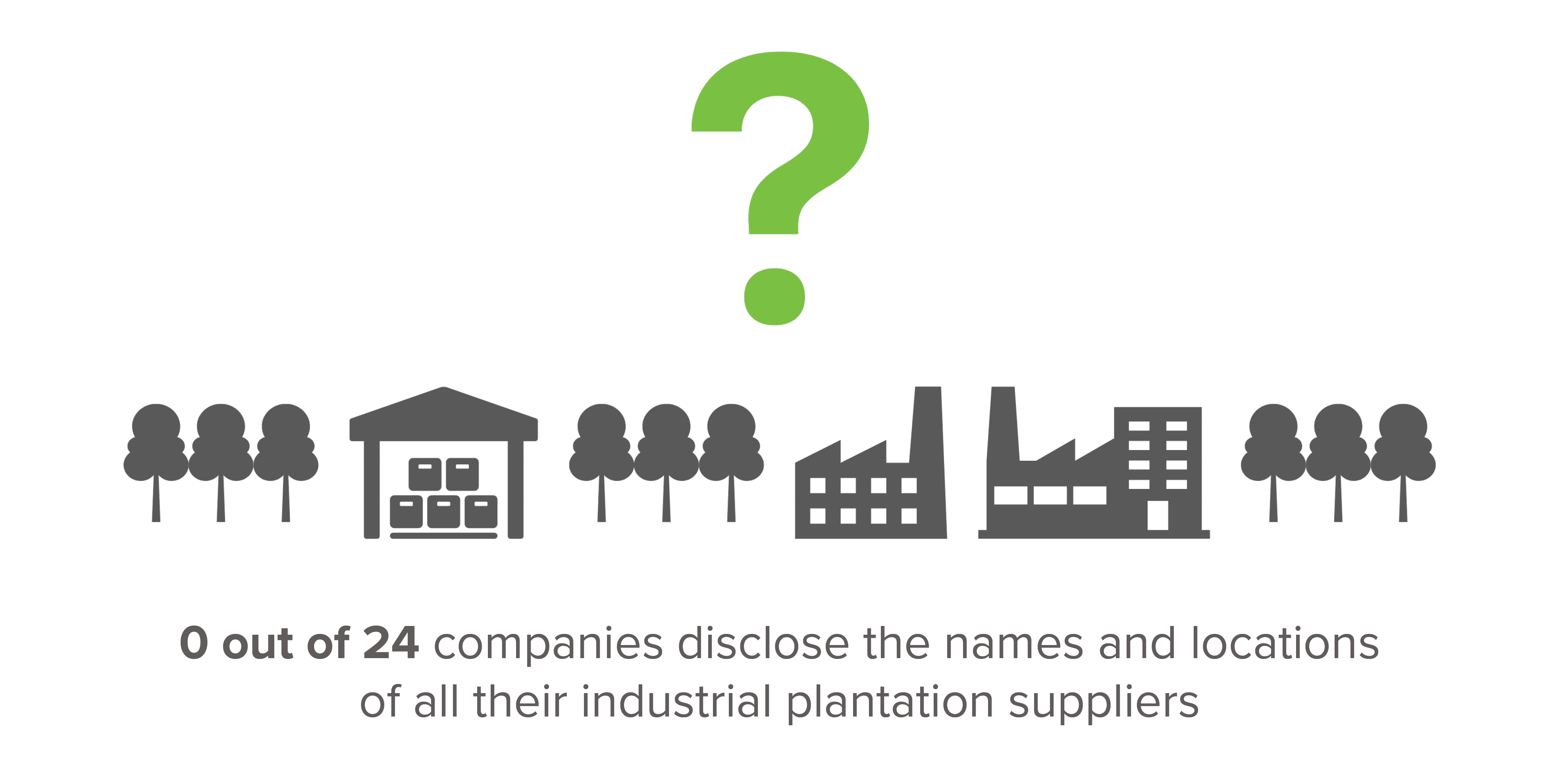

ZSL recommends companies to trace, map, monitor and verify their supply to build and sustain a credible, deforestation-free supply chain that both meets and expands upon EUDR requirements. Companies should start by tracing the most straightforward supply chains – processing factories buying directly from industrial plantations. Yet none of the 24 companies sourcing from these plantations disclose the full list of supplier locations. The absence of this data could indicate a lack of readiness for the industry to comply with EUDR requirements or a hesitation to expose supply chains to external scrutiny.

Sam explained that regulations aren’t the only way that a lack of action could cause companies to lose business: “Sustainability isn’t just about compliance; consumers, investors and buyers are demanding real action. Companies that fail to adapt won’t just lose access to key markets, they’ll lose business to competitors who take sustainability seriously.”

The urgency is heightened with the industry’s growing vulnerability to climate change, with the global loss of carbon-capturing trees being a major contributor to this crisis. Rising global temperatures are increasing the risk of severe weather events; 2024 saw extreme heat and devastating floods in China and Thailand, the world’s largest grower, leading to poor growing conditions, significantly reducing rubber yields and pushing prices to reach a 13-year high.

Flooding in parts of Thailand reflects the growing climate risks facing rubber supply chains

Sam said: “Despite these extreme weather events exposing the rubber industry’s vulnerabilities to climate impacts, most companies still lack basic deforestation monitoring – leaving them unable to prevent forest loss and continuing the industry’s contribution to the climate crisis. This risks creating a vicious cycle, where climate-driven disruptions reduce supply, driving up rubber prices and incentivising more deforestation. With little transparency or action, it’s uncertain if the industry is making any real progress toward protecting our forests.”

The report is published a week after the publication of the ZSL-endorsed 2030 Global Forest Vision: Priority Actions for 2025, which outlines the actions needed this year to keep the 2030 deforestation targets within reach, for the benefit of people and wildlife globally.

Buyers, investors, and policymakers are also key to driving change in the sector by calling on companies to disclose this information as part of ESG performance requirements. Beyond looking at public disclosure, the team behind the report emphasise that it is essential these key players regularly track suppliers’ progress, cross-reference data using tools such as SPOTT’s media monitor, identifying gaps between what has been reported and what is actually happening on the ground. Without a collective effort, the rubber industry will remain a blind spot in the global mission to build a world where people and nature can both thrive.

ZSL believes nature can recover, and that conservation is most effective when driven by science. We call for science to guide all global decisions on environment and biodiversity and build a healthier future for wildlife, people and the planet. Find out more and support ZSL’s world-leading, collaborative science and conservation work at www.zsl.org

Rubber plantation in Thailand by Oliver Cupit

*) All findings in this report are based on publicly disclosed information available at the time of assessment. Data reflects company disclosures at the end of January 2025.

Have your say on the SPOTT 2025 Timber & Pulp Indicator Framework

We would like to invite you to provide feedback to us on the SPOTT Timber and Pulp indicator framework ahead of the 2025 assessments.

Each year we review the indicator framework to ensure it is in line with best practice and provide more detail/clarity on how information is scored. The consultation period starts today and lasts two weeks, please read the framework and provide feedback on indicators.

A copy of the indicator framework in Excel format can be downloaded here. Column H contains the new scoring criteria, with updates to text in blue and deleted text in red. Column J summarises the changes to the framework.

Key proposed change in the 2025 assessment

Proposed changes to scoring criteria are due to the evolution of best practice, alignment with improvements in the SPOTT Natural Rubber and Palm Oil frameworks, and a result of feedback from assessed companies and other stakeholders.

We propose one significant change this year:

- Traceability Practice indicators (#40 and 42), scoring on the disclosure of percentages of traceable supply, will now award one additional point if data is externally verified. For example, a disclosure stating 50% of supply is traceable would score 0.5 points, if that data has been externally verified the score will be 1.5 due to one additional point awarded for external verification. Please see the SPOTT Methodology for the rationale behind awarding additional points and what constitutes external verification.

How to submit your feedback

We appreciate the time it takes to review a framework so if you are limited in capacity filter column J to see all changes, but feedback on all indicators is welcome. Please add any feedback in column P labelled ‘Reviewer comments’ and email your Excel to samuel.ross@zsl.org – the last date for providing feedback on the revised indicators is Monday 24th February.

2025 SPOTT Timber & Pulp Provisional Assessment Timeline

- April-May 2025 – Analysts score company reporting and create a draft SPOTT assessment for each company

- June-July 2025 – Assessed companies are consulted on their draft assessments

- August/September 2025 – The finalised assessments are published on the SPOTT website

If you would like to discuss the indicator framework or assessments in more detail, please get in touch. If you are having issues downloading the framework we can send the Excel file via email.

SPOTT assesses the most impactful producers, processors and traders in the timber and pulp sector on their public disclosure regarding the organisation, policies and practices related to environmental, social and governance (ESG) issues.

Assessed companies are reviewed on an annual basis to ensure that their inclusion continues to align with this aim and with the needs of our users. The review process includes desktop research as well as consultation with our Technical Advisory Groups. Our selection process considers a variety of factors, including:

- The location and extent of the producing and/or processing operations

- Nominations by interested stakeholders

- Companies that have volunteered for assessment

- Evidence of unsustainable practices identified through media reports

- Donor expectations

Change of company names

Three companies will be assessed under different names in 2025:

- PT Adindo Hutani Lestari (previously assessed as Adindo Foresta)

- Maxland Berhad (previously assessed as Priceworth International)

- Sumec International Technology Co.,Ltd (previously assessed as Sumec International Technology Trade)

One company to be removed from SPOTT in 2025

Grupo Cikel (assessed since 2017) will no longer be assessed due to a change in company structure and a significant reduction in forestry operations. All of Grupo Cikel’s previous assessments will remain accessible through the SPOTT website. The removal of Grupo Cikel allows for the inclusion of one new company.

One company to be included on SPOTT in 2025

In line with our company selection process and following our call to stakeholders for company nominations, we have identified Smurfit Westrock as an impactful company to include in the 2025 SPOTT timber and pulp assessments. Smurfit Westrock operates plantations in Brazil and Colombia and sources from various tropical forest landscapes. ZSL has attempted to notify the selected company regarding their forthcoming assessment on SPOTT.

SPOTT assesses the most impactful producers, processors and traders in the timber and pulp sector on their public disclosure regarding the organisation, policies and practices related to environmental, social and governance (ESG) issues.

Assessed companies are reviewed on an annual basis to ensure that their inclusion continues to align with this aim and with the needs of our users. The review process includes desktop research as well as consultation with our Technical Advisory Groups. Our selection process takes into account a variety of factors, including the location and extent of the producing and/or processing operations, nominations by interested stakeholders, companies that have volunteered for assessment, evidence of unsustainable practices identified through media reports, and donor expectations.

Nominations welcome

Ahead of this year’s SPOTT assessments we are calling for public nominations of tropical timber and pulp companies. More information on our selection process can be found here.

You can submit company nominations anonymously here.

Or send us an email: spott@zsl.org

The deadline for the submission of company nominations is 31/01/2025.

Using Forest IQ data to help financial institutions undertake the Locate, Evaluate, Assess and Prepare (LEAP) approach of the Taskforce on Nature-related Financial Disclosures (TNFD).

As nature-related risks and environmental accountability become critical in today’s financial landscape, Forest IQ offers a unique solution for financial institutions and soft-commodity companies. This comprehensive data platform, developed by the Zoological Society of London (ZSL), Global Canopy and Stockholm Environment Institute (SEI), helps financial institutions enable their transition to deforestation-free financial portfolios.

What you’ll learn in this report

- The strengths and limitations of the Forest IQ platform

- Adoption of the LEAP approach as outlined by TNFD

- How financial institutions are currently using Forest IQ and its associated tools in the context of the TNFD

- How to overcome the limitations of self-reported data using satellite-based assessments for data verification

Case studies and real world examples

Insights from leading financial institutions, including Schroders, Robeco, Federated Hermes, and Storebrand, demonstrating how they apply Forest IQ data to manage deforestation and ecosystem-related risks. By aligning with the LEAP approach outlined by TNFD, these institutions illustrate the practical steps and challenges in identifying and addressing nature-related risks within their portfolios.

Recognising the limitations of self-reported data, the report explores how satellite-based verification can enhance the reliability of deforestation insights. Through case studies of select companies, the report sheds light on the additional layers of assessment needed to verify corporate commitments to zero deforestation.

Who is this report relevant to?

This report is key for financial institutions and soft-commodity companies. Financial institutions can use Forest IQ to align with TNFD’s LEAP framework, strengthening their approach to deforestation risk. Soft-commodity companies gain insights into investor expectations, helping them align practices with sustainable finance standards and regulatory trends.

Forest IQ’s focus beyond deforestation

While the primary focus is on deforestation and ecosystem conversion, Forest IQ provides essential insights into associated human rights risks, offering a gateway for companies to advance on their TNFD journey. With over 2,000 companies assessed, the platform brings together data from SPOTT, Forest 500, and Trase, consolidating crucial metrics in one central location.

For a more in-depth look at how Forest IQ can transform your approach to managing nature-related risks, download the full report.