Palm oil investors are being urged to keep sustainability issues high on their agenda through a new report launched by international conservation charity ZSL (Zoological Society of London) in partnership with Aviva Investors.

Years after the first reports emerged linking the palm oil industry with environmental destruction and human rights abuse, the sector is still considered high risk for investors in 2018. Despite these concerns, global demand for palm oil continues to grow, accelerating expansion into regions such as West Africa.

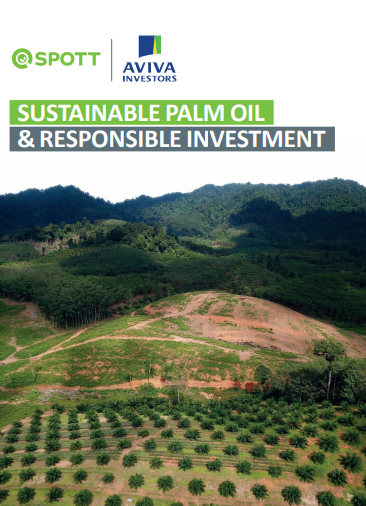

The report from Aviva Investors and ZSL’s dedicated Sustainability Policy Transparency Toolkit (SPOTT) team – Sustainable Palm Oil and Responsible Investment – highlights that investors have the power to transform the whole palm oil industry, by encouraging the companies they finance to adopt more responsible policies on deforestation, land conflicts and labour conditions. Focusing on the palm oil investment case through case studies, it outlines key questions that institutional investors should ask during their engagement with oil palm growers, traders and buyers, to help incentivise improvements to their environmental, social and governance (ESG) practices.

Joyce Lam, Manager for ZSL’s SPOTT team, comments: “Palm oil is not going away anytime soon, and neither are the risks associated with it. The good news is that the push for more transparency and corporate disclosure is no longer the sole concern of environmental and social NGOs. Investors have become more aware of the financial, operational, and ESG risks associated palm oil production. This makes investors a driving force in bringing the laggards up to speed. ZSL is proud to partner with Aviva Investors to publish this guide, which – together with the transparency assessments of palm oil companies that SPOTT provides – is designed here to support these vital conversations.”

The palm oil sector has become infamous for malpractices including companies and smallholder farmers resorting to damaging slash-and-burn practices to clear forest for plantation development. Documented cases of deforestation, land conflicts and forced labour has meant that palm oil producers and buyers have seen their operations disrupted and criticised. Intense public campaigns against these practices has led to increased reputational risk, governmental scrutiny and regulatory pressure. As the negative impacts of palm oil production increasingly impact the reputation of institutional lenders and investors in the palm oil sector, the case for engagement by the finance sector to push for sustainable palm oil production is becoming ever-stronger.

As a result, many businesses and financial institutions have now made commitments and adopted NDPE (‘No Deforestation, No Peat, No Exploitation’) policies, to exclude unsustainable palm oil from their supply chains and investment portfolios. However, implementing such commitments in practice is slow and complex. Even though various companies and financiers have made sustainability commitments to address ESG risks, many are yet to follow, thus potentially creating ‘leakage’ and an uneven playing field across the industry.

Abigail Herron, Global Head of Responsible Investment for Aviva Investors, said: “Investors have the power – and indeed the moral duty – to push for best practice in the palm oil sector. The business case for investment in the palm oil sector cannot ignore environmental and social considerations and, together with ZSL, we are calling for increased engagement with companies to help speed the transition towards a sustainable palm oil industry. We hope this guide promotes greater transparency across the sector and encourages fact-led dialogue to steer current practice in the right direction.”