Rubber products are present in our daily lives, often without us even noticing. From mattresses to toothbrushes, the shoes we wear on our feet, to the tyres on cars, buses and bikes, lining conveyer belts, asphalt and yoga mats, in balloons, condoms, phone covers and hot water bottles – all these objects contain some form of rubber. However, despite this widespread use we rarely stop and wonder if the rubber in these products comes from sustainable sources.

What is rubber?

There are two types of rubber: natural and synthetic. Natural rubber can be produced from several different species – and even from dandelions – but the species most commonly used by industry is Hevea brasiliensis, a tropical tree native to Latin America. Natural rubber is made from the latex sap of the rubber tree while synthetic rubber is produced from crude oil. Although the majority of rubber products are now made using synthetic rubber, natural rubber has unique characteristics such as high mechanical resistance or resilience that makes it an essential ingredient for many products. In 2017, 46.5% of the global rubber consumption was natural rubber and around 70% of this was used by the tyre industry. Tyre manufacturers use a combination of natural and synthetic rubber because both have properties that are important in tyres, and it is currently impossible to fully substitute natural rubber with synthetic – for example, aircraft tyres are made of 100% natural rubber.

Natural rubber production and demand

Natural rubber is mainly produced in the tropical regions of Asia. Just six countries provide 95% of global natural rubber production: Thailand, Indonesia, Malaysia, Vietnam, India and China. The majority (85%) of production is provided by smallholders, usually owning less than 5 hectares of either monoculture plantations or agroforestry where rubber trees are grown amongst other crops. The remaining natural rubber is produced by large companies on industrial monoculture plantations. The top consumers of natural rubber in 2017 were China, USA, Malaysia, Japan and South Korea.

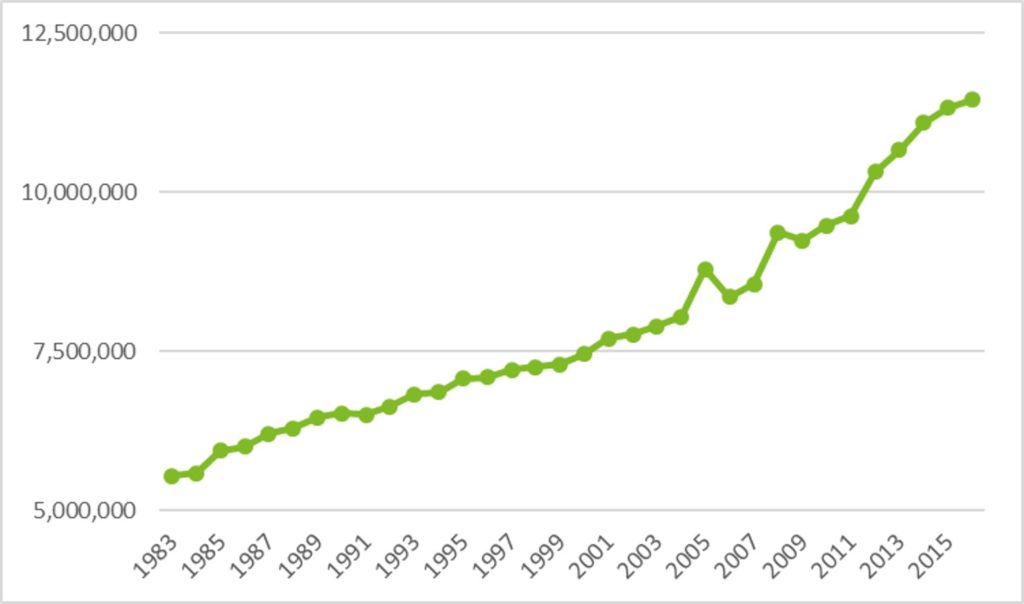

In the past two decades, natural rubber consumption has increased. This increase is primarily due to its use in tyre manufacturing, as demographic expansion and higher purchasing power in emerging markets has led to increased transportation needs. There is also likely to be an increasing global shift away from fossil fuel-based products such as synthetic rubber. The area under natural rubber cultivation doubled from 5.5 to 11 million hectares [i] between 1983 and 2016 and demand for natural rubber is expected to grow even more in the short to medium term – although there are also forecasts of overproduction in the next few years.

World production of natural rubber (area harvested in hectares) between 1983 and 2016. Source FAOSTAT [i]

ESG risks in the natural rubber sector

Natural rubber tends to receive less attention than other commodities (e.g. timber, soy, palm oil). This is mainly due to the nature of its production, which tends to be by smallholders via small-scale plantations or agroforestry system. These methods of production are thought to have lower social and environmental impacts than large-scale monocultures. However, poor management practices and associated low productivity can lead to negative social and environmental impacts, including pollution, health issues, and poverty.

In addition, the rapid expansion of large-scale natural rubber monocultures in southeast Asia in the past three decades has resulted in many of the same issues that have been associated with the production of palm oil, pulpwood, and other plantation-based commodities. For instance, natural forests have been converted to rubber plantations leading to biodiversity loss and degradation. In Cambodia, rubber plantations were developed in protected areas, while a UNESCO World Heritage Site is currently being threatened by expansion of rubber plantations in Cameroon. Besides environmental issues, land grabbing and various human rights violations are also associated with industrial rubber monocultures.

Production is not the sole source of negative environmental and social impacts in the rubber sector. Processing of natural rubber also involves using large amounts of chemicals at various stages of processing, which poses health and safety and pollution risks.

Emerging standards for sustainability

Unlike the palm oil, forest products, and soy industries, there is no overarching sustainability certification standard specifically for natural rubber (except for FSC certification as a non-timber forest product). However, there are some existing and emerging sustainability initiatives (e.g. Sustainable Natural Rubber Initiative (SNR-i), Global Platform for Sustainable Natural Rubber and the Fair Rubber Association) and more and more downstream companies are also making sustainability commitments requiring their whole supply chain to adhere to these commitments – for example within the automotive industry.

Tapping into a sustainable future

There are growing sustainability challenges in the natural rubber sector which will require a strong and unified response from businesses in the rubber supply chains, their investors, governments, and civil society organisations that monitor and engage with these actors. The environmental and social issues associated with rubber production represent financial, regulatory and reputational risks to both the downstream companies and financial institutions involved. To respond to these risks greater industry transparency will be required in order to bring about targeted change.

For this reason, after the successful application of the SPOTT model in the palm oil and the timber and pulp sectors, ZSL now plans to expand SPOTT to cover natural rubber production. The initial focus will be private sector companies with large-scale rubber plantations – i.e. those associated with the largest potential environmental and social impacts and with the largest capacity to bring about the required transition into more sustainable rubber production.

With a growing number of sustainability initiatives and interest from finance sector and supply chain actors, there is a growing momentum towards sustainable production in the natural rubber sector. By casting a light on the policies and practices of significant producer companies in this sector SPOTT will help to support engagement with leaders and laggards within the industry.

ZSL will launch SPOTT assessments of rubber companies in autumn 2019 – watch this space!

Nominate rubber producers

Please contact us if you have any comments or to nominate a natural rubber company that you would like to see assessed on SPOTT.